Most people talk about buying a house like it’s an unskippable event required to hit the next level in life.

Many times growing up I heard things like:

“Renting is throwing money away.”

“You need to build equity.”

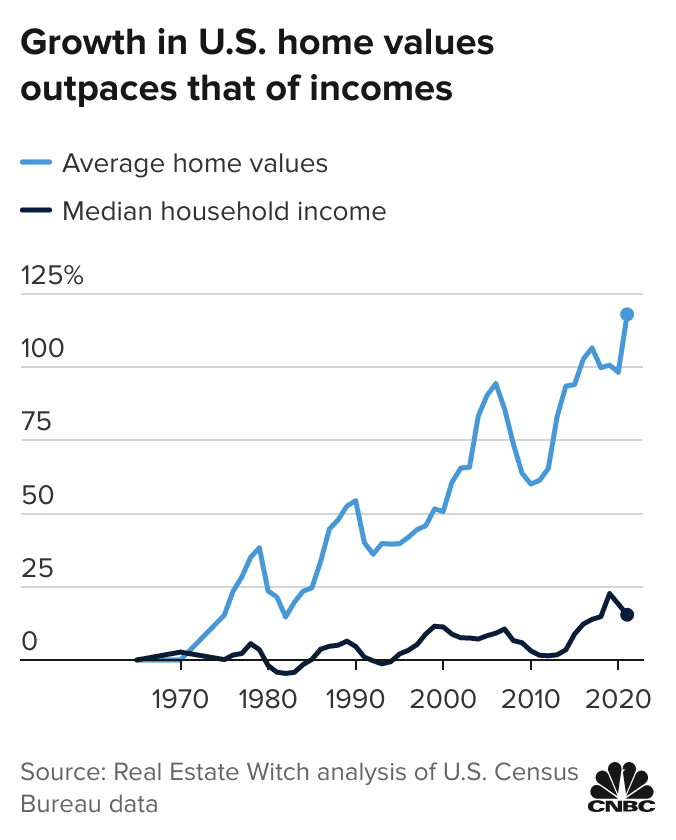

And for a while that made sense. Job security and the ratio of home price to income was a lot more favorable to the average person.

Times have changed.

What if the whole concept of buying a house, or more accurately signing a 30-year death contract and paying hundreds of thousands in interest, is actually something marketed to us, playing on our egos. Some men who embrace minimalism will still fail to realize purchasing a property is one of the largest losses of time, freedom, and mobility.

If you’re interested in living in the middle of nowhere in Michigan or South Dakota this post isn’t for you.

This is a breakdown of the real trade-offs between renting and owning from a minimalist’s perspective grounded in actual costs, freedom, and personal wellbeing (that includes women, sorry mountain men).

The Truth: Renting Is Often the Better Move for Minimalists

A core principle to a grounded and stoic mindset is the understanding that the more things you own, the more things own you.

Every purchase has an explicit economic cost, but not included in most price tags are a list of the responsibilities, errands, unexpected problems, and mental clutter that come with buying anything.

Especially a house.

The Three Big Costs Every Homeowner Pays

Every piece of property comes with three unavoidable expenses, regardless of if you purchase a $2.5 million dollar ranch house or a $30k shack on the outskirts of Boisser City, Louisiana:

- Maintenance

- Property taxes

- Insurance

People obsess over the mortgage but forget these unavoidable constant costs. And they’re not small. A pipe bursts, the roof leaks, the AC dies — that’s all on you and whoever in your area is available to fix them. When you rent? Those headaches disappear.

Well, not completely. But they aren’t your problem to fix.

Your mortgage is the least you’ll ever pay each month, while your rent is the most.

Economies of Scale Work in Your Favor When You Rent

One property manager for a building of 40–200 units is extremely efficient.

Compared to you maintaining a single house alone, apartments simply cost less per person.

That’s why in most markets:

Renting a small apartment is cheaper even after factoring in home equity gains.

The Hidden Factor Nobody Talks About: Your Time

This is the part most people, even with cash flowing properties, miss.

If you rent, you don’t mow lawns, fix gutters, replace water heaters, argue with HOAs, or handle surprise city notices about sidewalks or zoning. That reclaimed time has real value.

Ask yourself:

What does an hour of my time cost?

I’ll make another post detailing the compounding interest calculations of an hour of work today will be worth in the future.

Utilized properly, the time saved from renting can deliver between thousands and millions in future earnings.

The Commute Tax: The Silent Financial Killer

“Yes, buying a house is cheaper… it’s just an hour away from work.”

People don’t factor in:

- Gas

- Car maintenance

- Higher insurance

- Extra childcare logistics

- Lost daily hours

- Stress

If living close to work costs $150–$300 more per month, but saves you 10 hours per week?

That’s a bargain.

Minimalism of the Mind

Picture an incredibly minimal apartment. Probably looks like something out of an anime.

Most young men’s living spaces resemble this. Especially when we are hungriest and most focused.

Why do we naturally do this?

It’s because a small space facilitates a clean mind. And a clean mine facilitates good decisions.

When you rent, you don’t worry about:

- The roof

- The yard

- The mortgage rate

- Surprise repairs

- HOA politics

- Property disputes

That peace of mind is worth more than the theoretical capital gains of a home you may not even stay in long-term. Minimalism means a rejection of both unnecessary possessions and responsibilities.

When Owning Does Make Sense

All that said, owning isn’t bad. It just needs to be the right type of ownership, for the right reasons.

You should consider buying if:

1. You plan to live in the area long-term.

Five years minimum, ideally ten.

2. The property genuinely improves your life or creates income.

A small house you love full of everything you need or a large property where income can be generated from the space.

3. You buy exactly what you need, not what society tells you to buy.

For example: One-bedroom above a 3-car garage. Functional, cheap, efficient.

4. You buy land with freedom.

No HOA. No Karens. No McMansion requirements. This gets rarer by the day.

5. You’ve run the numbers honestly.

Not just principle and interest.

Property value projections, property tax projections, energy options, upcoming roof repairs, etc. .

If the personal upside outweighs the added responsibilities, owning can be great.

A Smart Trick Before Buying: Test Drive Your Lifestyle

You wouldn’t marry someone without going on a date.

You wouldn’t buy a car without driving it.

So why buy a house without testing the lifestyle?

Rent an Airbnb that resembles the home you want:

- A small cottage

- A minimalist “bachelor hut”

- A condo near the beach

- A tiny house on land

Stay for a week. Clean the whole place yourself.

See what feels right.

This could save you millions down the road.

Test drive your housing the same way you test drive a relationship.

Freedom Is the Real Asset

Many times in my life I’ve had to move for opportunity. And those moves have put me in th position I’m thankful to be in.

But what would have hindered those moves? A real estate investment I couldn’t quickly get out of.

Despite all of these points, I still believe in real estate as a great portfolio diversifying asset class, just not domestic.

Owning a home can be great when it’s aligned with your lifestyle, values, and long-term plans.

But most people really don’t buy homes for themselves.

They buy them to fit in or because they were told to.

V3 men don’t play that game.

You’re allowed to prioritize freedom.

You’re allowed to value time over square footage.

You’re allowed to rent because it gives you the life you actually want.

Renting is not “ throwing money away” — it’s the smartest, most minimalist financial move you can make.